Mining For Gold – Trading Dominion

Original Price: 1775$

You Just Pay: 169.95$(One Time 88% OFF)

Author: Trading Dominion

Sale Page:_n/a

Product Delivery : You will receive a receipt with download link through email.

Contact me for the proof and payment detail: email_Ebusinesstores@gmail.com Or Skype_Macbus87

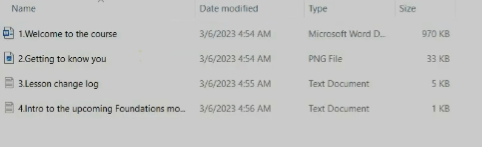

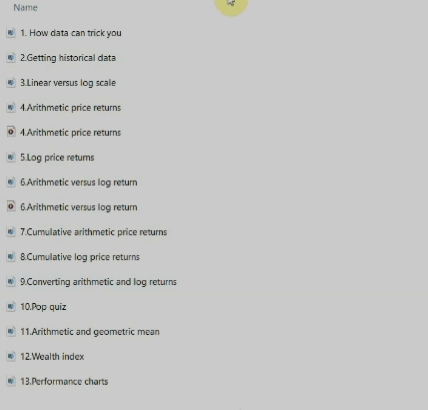

PROOF COURSE:

Course overview

Mining For Gold – Trading Dominion introduces to you the methodology experts use to maximize their gains. With the knowledge earned in this course, you will be able to see the real-world performance of this style of trading with a 3rd party broker tracker. The course also shares with you different architecture setups for higher and more steady income.

This course is designed for Day Trading, Futures Trading, Forex, Cryptocurrency, etc.

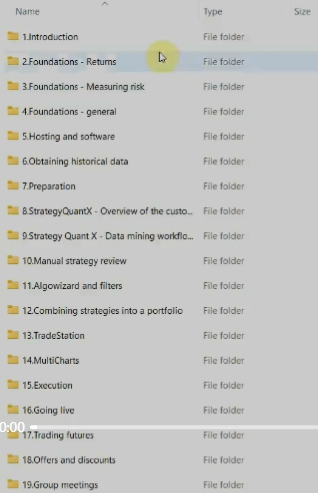

Course Outline

Introduction

- Foundations – Returns

- Foundations – Measuring risk

- Foundations – general

- Hosting and software

- Obtaining historical data

- Preparation

- StrategyQuantX – Overview of the custom workflow

- StrategyQuant X – Data mining workflow details

- Manual strategy review

- Algo Wizard and filters

- Combining strategies into a portfolio

- TradeStation

- MultiCharts

- Execution

- Going live

- Offers and discounts

- Group meetings

- The finish line

What will you learn?

- How to master algorithmic trading with zero programming.

- How to diversify your algos across all instruments, sectors, markets, as well as timeframes

- How to make the most of advanced software to find trading edges for you and then validate their robustness.

- How to save time from being glued to the computer watching every tick.

- How to trade dozens of algos at the same time.

Who is this course for?

This course is ideal for traders who:

Lack of diversification across multiple instruments.

Lack of time to trade multiple strategies.

Lack of time to do intraday trading.

Do not know how to code.

Know to code but not how to go about creating and validating trading systems.

Scared of making emotional trading decisions rather than strictly following a trading plan.

Do not understand how the technology pieces fit together.

Scared of creating systems that could be curve-fit.

Believe that the market is totally random.

Do not have a mentor with a proven methodology.

Not able to validate a proven track record.

Concerned over interest rates being at zero and therefore uncertain of future performance of bonds.